For some months now, I have been discussing how best to measure the value-add of the supply chain with Lora Cecere and Abby Mayer at Supply Chain Insights. Abby has started the Supply Chain Index blog and Lora’s latest blog is titled “What I have learned about supply chain excellence”. In other words they are on a mission, one in which I believe. I encourage you to read up on what they are doing.

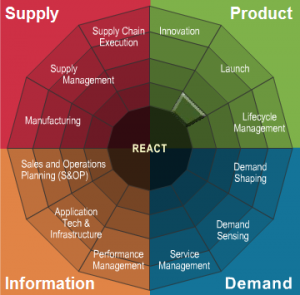

Coming back to the distinction between Supply Chain and Operations, I want to bring in Gartner’s Top 25 list which they have published for past 10+ years. While there is much that we can criticize in Gartner’s methodology, a fundamental point is that Gartner tries to balance sustainable profitability with supply chain effectiveness. Moving the mouse over the figure below on the Gartner web site brings up call-outs that relate the different operations aspects of Supply, Product, Demand, and Information to the Gartner maturity model levels of React, Anticipate, Coordinate, Orchestrate. It is the balance across several aspects of Operations that I find to be compelling in Gartner’s approach. While I do not quite agree with Gartner that revenue growth is a perfect measure of sustainable profit, the key point is that Gartner is bringing in more functions than purely Supply Chain, particularly Product, to capture innovation, as well as information to capture process innovation. Lora uses Profitable Growth instead of Revenue Growth. In other words, if all you focus on is efficiency by reducing Working Capital requirements you may be starving innovation and therefore future revenue. It is the trade-offs – there’s that word again – between investing in the company through effective Operations, not just Supply Chain, that drives sustainable profitability. As a quick side note, investing in product innovation is not a guarantee of sustainable profitability, but not investing in product innovation is a sure way to go out of business. It is for this reason that I prefer to look at Free Cash Flow (FCF) because it includes how much a company is investing in capital equipment, which is an indirect measure of how much they are investing in process innovation, which itself is a driver of productivity gains, another important metric for measuring supply chain effectiveness. Nearly anyone can make a company profitable in the short term by reducing investment in innovation, which is why I prefer FCF over OCF as the metric to use for measuring sustainable supply chain effectiveness. It is truly a measure of how much cash is generated by a company. If a company does not invest in product and process innovation it won’t show sustained profitability over the medium and long term. It is aligning all aspects of Operations that truly drives growth in Operating Income. But in today’s outsourced environments so much of Operations is outside the four walls of a company, which is why an outside-in approach is so important. Alignment of all of the Operations functions to satisfying the financial objectives set by senior executives is crucial to sustained profitability. Orchestrating the achievement of the company’s financial objectives through an operating strategy and managing the visibility, agility, and alignment across functional and organizational boundaries is where Operations Control Towers come into play. I’ll be writing more about Operations Control Towers over the next few weeks. In closing, as I have commented previously in a blog titled “Real Option Analysis is relevant to Supply Chains too”, I am really encouraged by the increasingly sophisticated manner in which we are measuring our supply chain effectiveness, exemplified by the prospect who challenged me on Gross Margin. So let me know about your journey in financial understanding, perhaps even your company’s journey, and what the next steps will be. If you think I am blowing smoke, tell me why.

Discussions

A great point. It's important to keep both the short term and long term in mind. What you do know to make a positive change might actually come back to haunt you in the end if you don't account for the long term impact.

http://www.tobyelwin.com/the-cost-of-culture-a-50-turnover-of-the-fortune-500/

Leave a Reply